Real-world asset (RWA) tokenization is often described as one of crypto’s most promising frontiers, but also one of its misunderstood.

Behind the jargon, tokenization is reshaping how traditional assets, such as U.S. Treasuries, private credit, and commodities, are held, traded, and integrated into digital markets.

The new 2025 RWA Report, published by Dune and RWA.xyz, analyzes over $30 billion in tokenized assets across leading protocols. It maps out how the sector is evolving, what’s driving adoption, and where the next opportunities are emerging.

Why this RWA Report matters

It is the new bible for RWA tokenization.

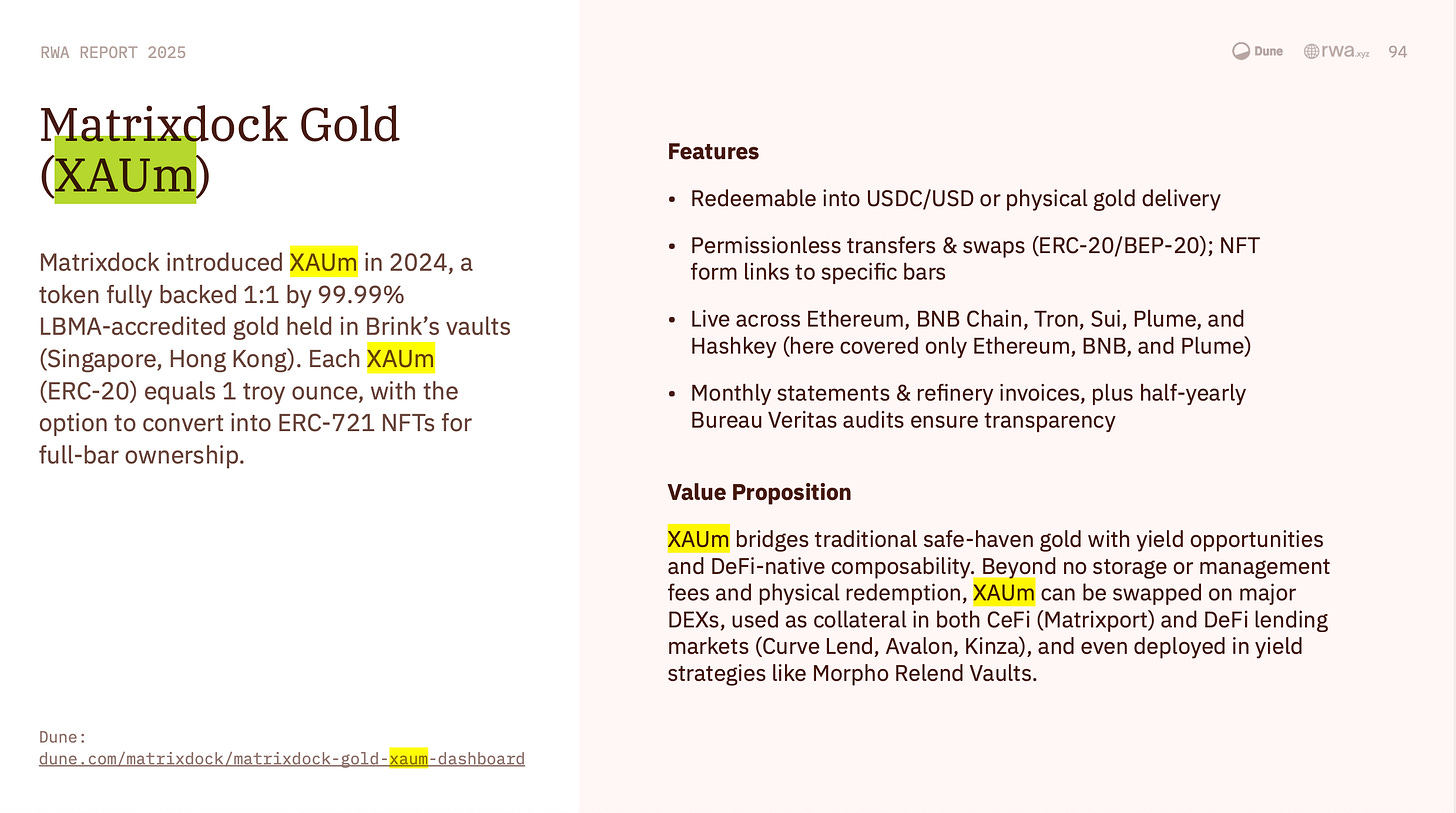

Tokenized U.S. Treasuries have achieved the strongest product-market fit, led by BlackRock’s BUIDL, Ondo’s OUSG/USDY, and Franklin Templeton’s BENJI, establishing themselves as the anchor assets for onchain yield. Beyond Treasuries, global bonds and private credit are gaining traction through projects like Spiko’s Euro T-Bill fund, Etherfuse Stablebonds, Maple Finance, and Tradable, as investors climb the risk-return ladder. In commodities, gold dominates with Matrixdock’s XAUm, while new entrants are tokenizing oil and agricultural products to diversify exposure. Meanwhile, institutional funds, equities, and real estate are moving onchain through Centrifuge’s JAAA, Securitize’s MI4, Ondo’s Global Markets, and RealtyX. All these developments are signaling that tokenization is evolving from niche experiments into a broad, multi-asset financial infrastructure.

Commodities on-chain: Gold leads, XAUm scales

Among commodities, gold remains the dominant tokenized asset, serving as an inflation hedge and a trusted store of value during periods of macroeconomic uncertainty, particularly in today’s complex geopolitical landscape and amid the debasement of fiat currencies.

For Matrixdock and our flagship product XAUm, this report provides critical context on why tokenized gold is becoming an integral building block in the on-chain economy.

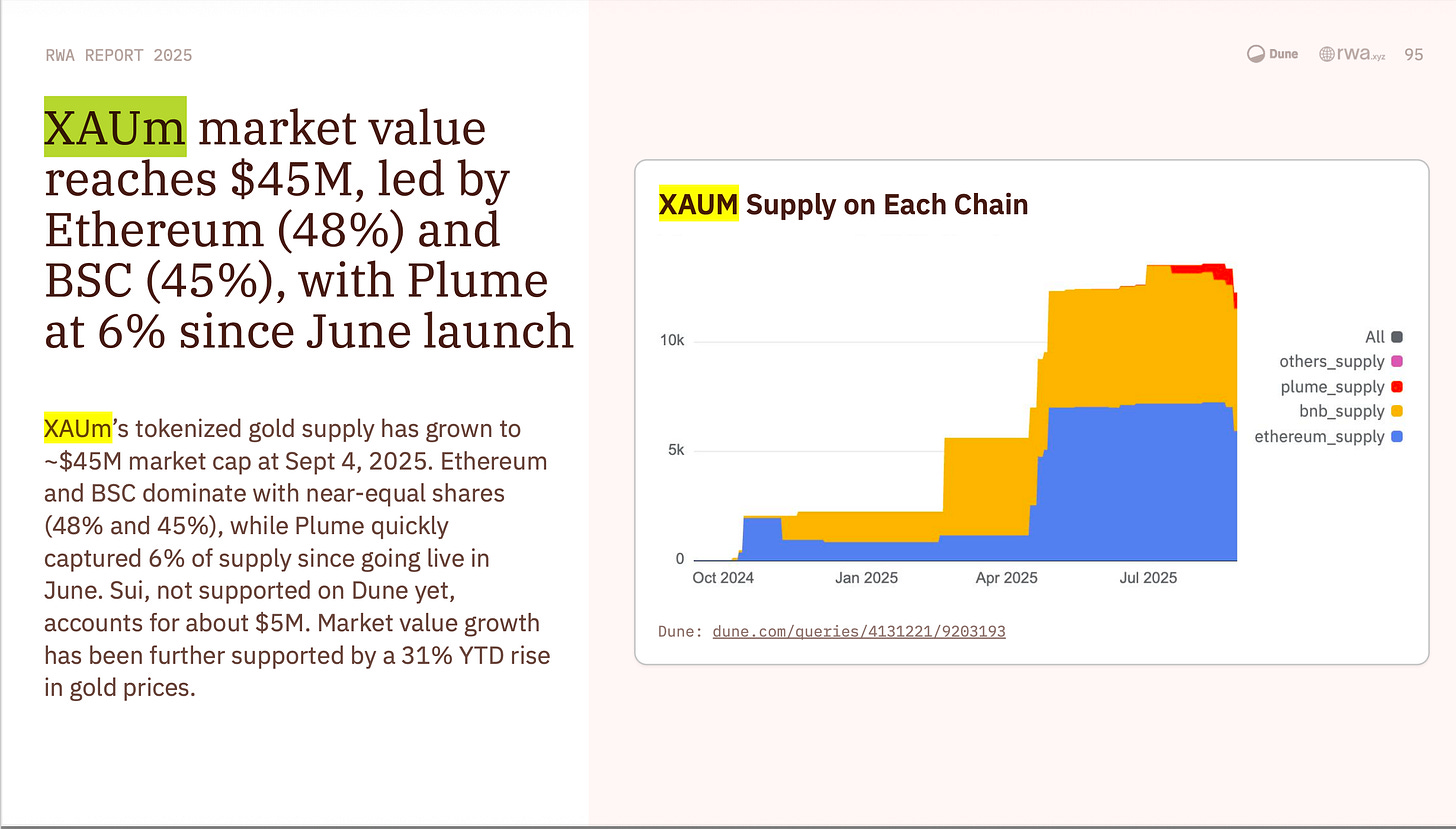

Matrixdock’s XAUm is now one of the largest tokenized gold products, with over $45M in market value and 365,000+ cumulative transactions across multiple chains. One of the key issues it is solving is the accessibility of investment-grade gold.

Other highlights:

13,200 XAUm tokens have been issued, each backed 1:1 by LBMA-accredited, 99.99% purity gold bars, and they are live on multiple blockchains for scalability and sustainability.

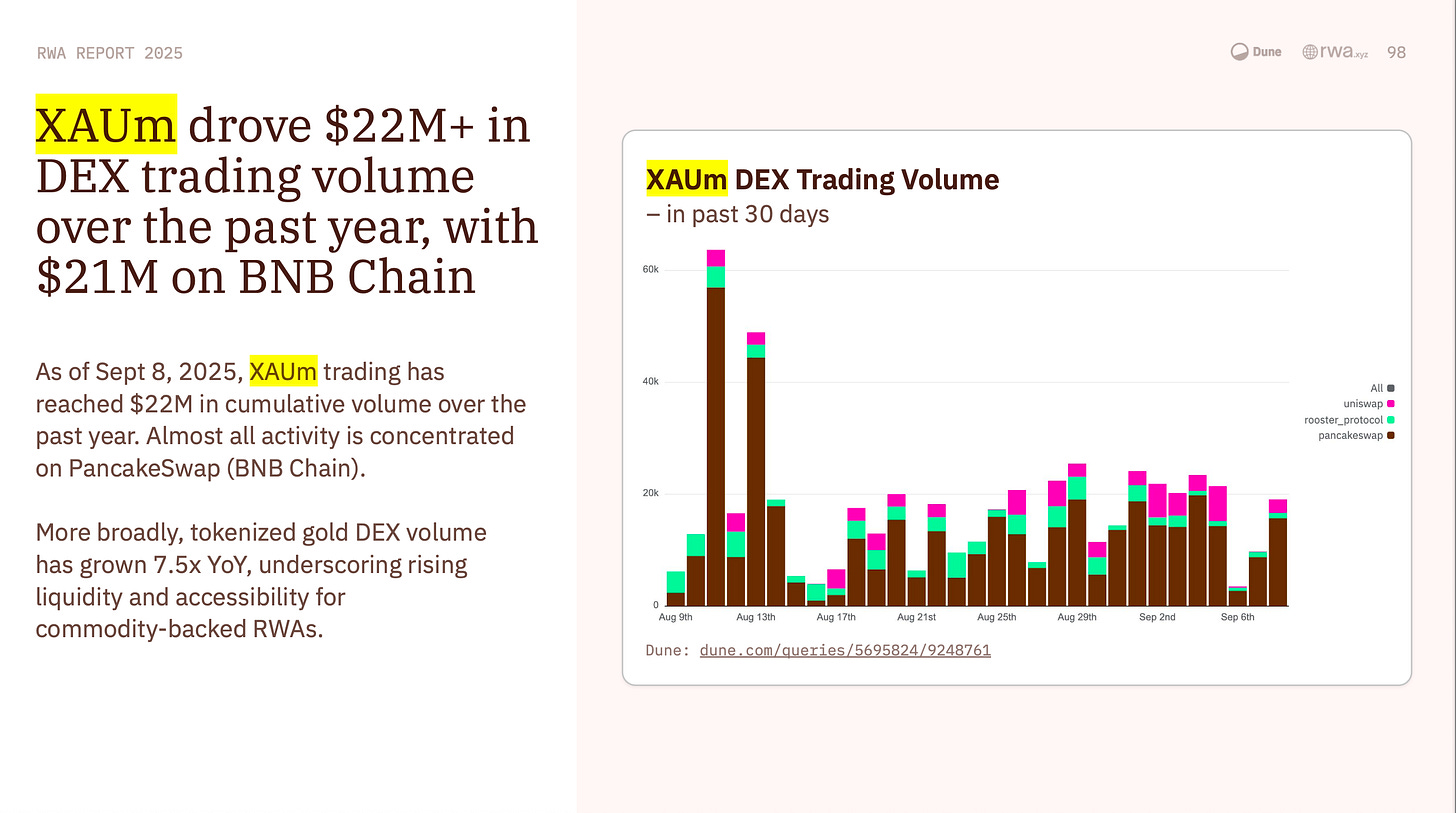

$22M+ in DEX trading volume over the past year, with BNB Chain and PancakeSwap leading activity.

A growing role in DeFi, where XAUm can be swapped, collateralized, and used in yield strategies, transforming physical gold into a programmable financial primitive.

Why this matters for the future of finance

The RWA Report underscores that we are moving from tokenization pilots to institutional adoption at scale. With over 224% sector growth since 2024, tokenized assets are evolving into the programmable foundation of global capital markets.

For investors, this means:

New access: Fractional ownership of assets once limited to institutions.

New transparency: Real-time proof of reserves and verifiable on-chain data.

New capital efficiency: The ability to use assets like gold or Treasuries as collateral, yield-bearing instruments, and building blocks in programmable portfolios alongside cryptocurrencies like Bitcoin.

XAUm embodies this transformation. By bridging the world’s oldest safe-haven asset with blockchain rails, Matrixdock is demonstrating how RWAs can combine tradition, trust, and technology into an inclusive financial system.

Download your report today: https://dune.com/rwareport2025