Market Cap

$84.82MTotal Supply

16,781.256 XAUmTotal Bullion Weight

16,781.256 Troy Oz.No. of Gold Bars

522Highest Standards of Gold & Storage

Asia's most trusted gold infrastructure, integrated with bullion markets and banks.

Dual-Layer Transparency. Fully Audited.

Independent physical audits by Bureau Veritas and regular asset statements from vaults, providing trusted transparency through third-party verification.

On-ChainProof of Reserves

On-chain Proof of Reserves will be launched soon, please stay tuned.

Matrixdock Gold Allocation Lookup

Real-time price quote is available in the mint/redeem web-app.

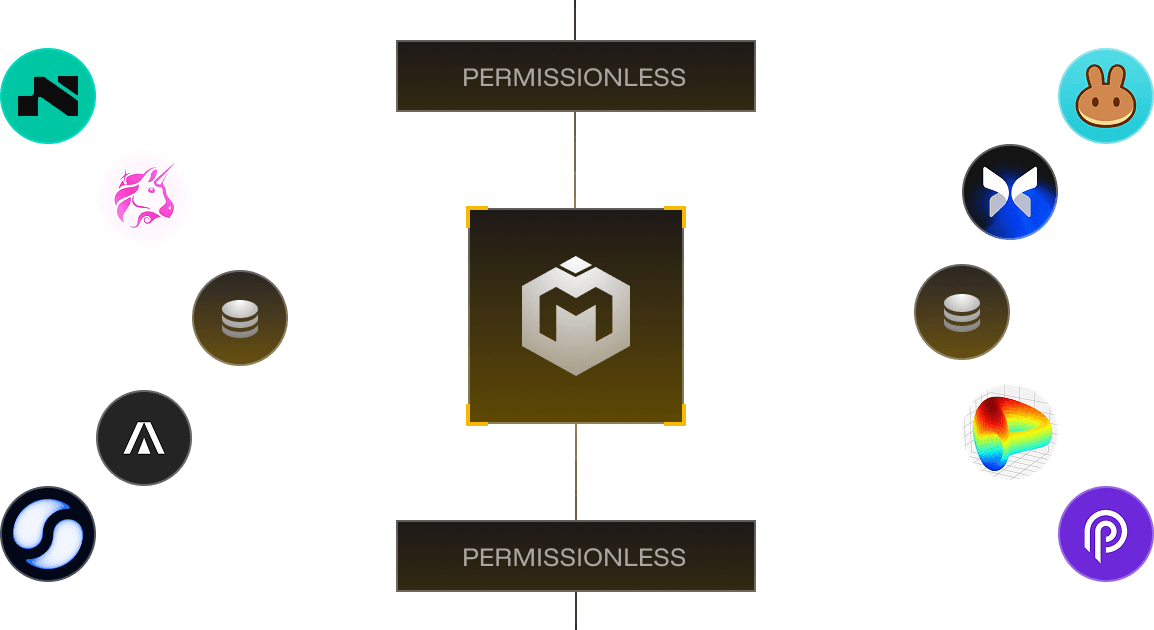

Unified Integrations Across Permission Models

Access XAUm seamlessly on both permissionless and permissioned workflows

Permissionless

Aggregated open access to major DeFi protocols and public data feeds

Permissioned

Secure access to primary minting, redemption, liquidation settlement and other Matrixdock services

XAUm Utility Across Venues

Matrixdock Gold is supported on the following platforms:

XAUm-Backed Lending

XAUm-backed structured financing solutions, directly originated and executed by TradFi institutions and banks, unlocking greater liquidity for institutional-grade capital efficiency.

XAUm Tokens

XAUm tokens are dynamically allocated to a gold bar. Token holders are able to check their dynamic allocation in real time.

Matrixdock Gold NFT

Users who want to have fixed allocations to specific gold bars can create Matrixdock Gold NFTs by packing the required amount of XAUm tokens.

On Chain, Productive, Composable

- XAUm programmable value, composable by design, built on trusted physical gold

- Unlocks yield opportunities, transparent structured strategies, impossible with traditional gold holdings