How does STBT Work?

Holding 1 STBT is equivalent to holding 1 USD net-asset value (NAV) of short-term U.S. treasuries, with daily interest received via rebasing mechanism on-chain.

Holding 1 STBT

Holding $1.00 Worth of U.S. Treasuries

Daily Interest

Total Distributed Interest

And APY History

Total Distributed Interest

And APY History

Since the launch day of STBT, over $5 million in interest has been distributed to STBT holders.

30d Avg.APY(%)

Total Interest($)

Exclusively Designed for Accredited Investors

STBT is exclusively tailored for Accredited Investors, this focus allows us to provide more targeted and enhanced services, ensuring a higher level of quality and attention to your needs.

Total STBT Supply

9,027,419.49 STBT

Etherscan

Total Reserves NAV

$ 9,153,013.65

| Assets | Composition of STBT | Composition of Reserves | Maturity | Laddering of Asset Classes |

$0.00M 0.00% | $0.00M | 1 Day |  | |

$8.43M 93.34% | $8.43M | < 3 months |  | |

$0.48M 5.29% | $0.48M | Not applicable |  | |

$0.12M 1.37% | $0.25M | Not applicable |  |

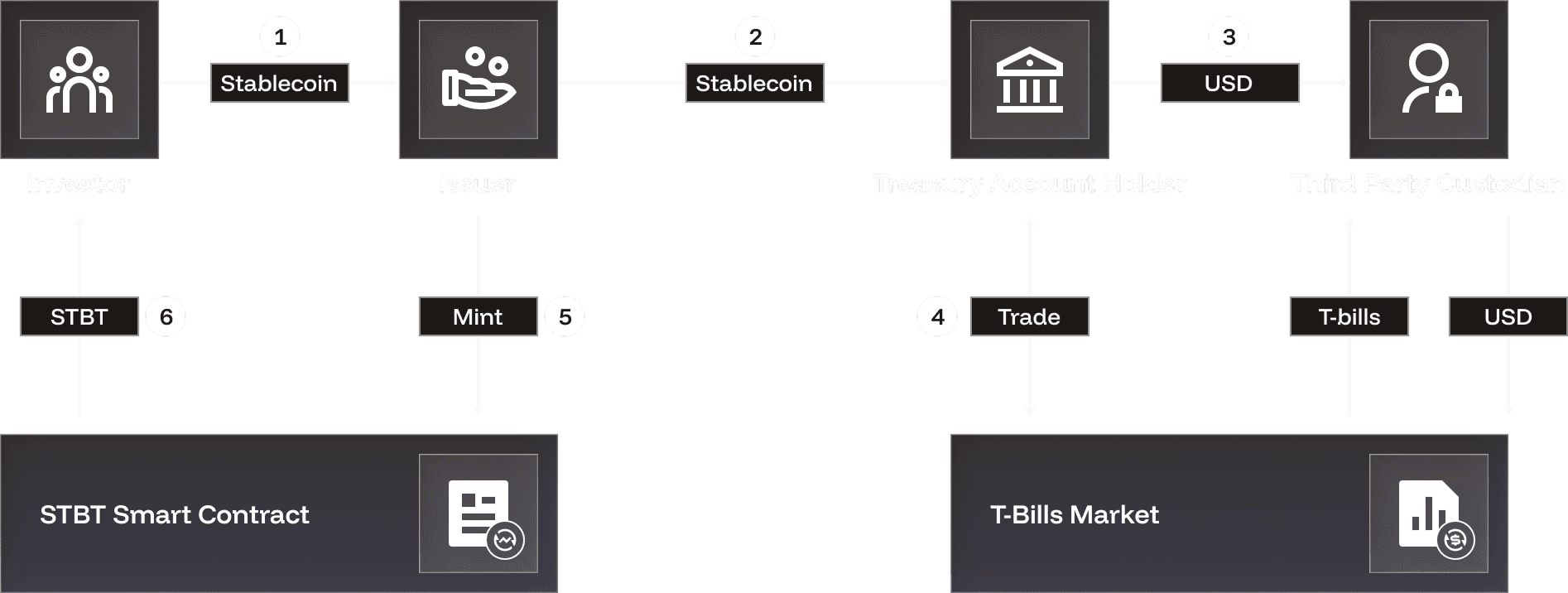

Mint, Redeem and Yield Flows

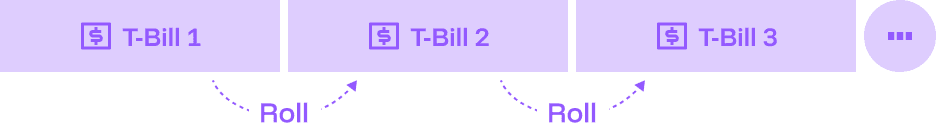

STBT offers a daily quota for T+1 (New York Banking day) quick mint and T+0 quick redemption. If the quota has been exhausted, remaining mint/redeem requests will usually be settled within T+2 days. View real-time quota >

FAQs

What are the STBT daily rebase rules for interest distribution?

How will the composition of underlying assets be determined?

How does the issuance and redemption of STBT work?

Why do the values of total network supply and total asset NAV differ?

What are the fees charged?