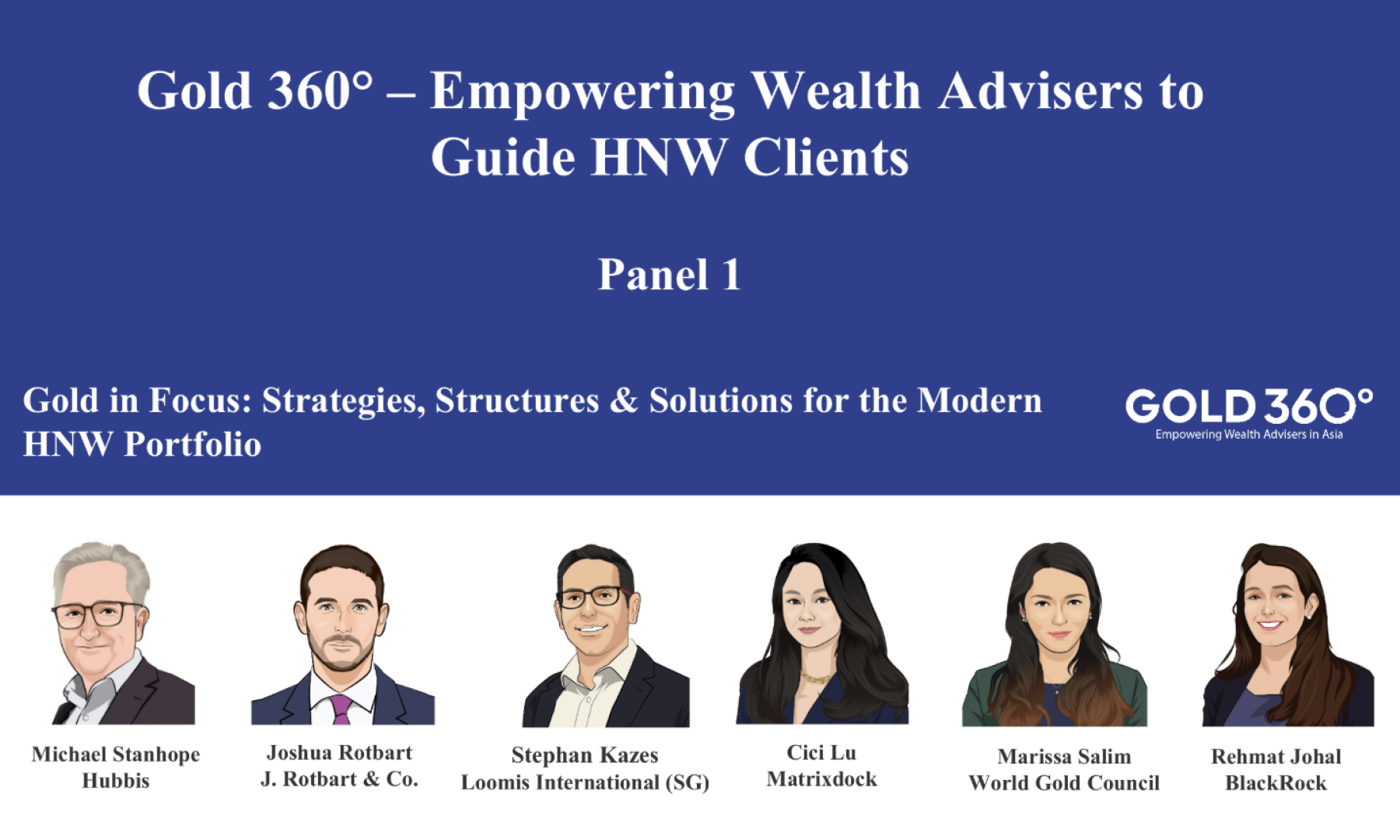

At the Hubbis Gold 360° Forum in Singapore, Matrixdock was honoured to share the stage with leading institutions shaping the global gold ecosystem:

World Gold Council

BlackRock iShares (Gold ETF)

J. Rotbart & Co. (Physical Bullion Specialist)

Loomis International (Institutional Vaulting & Logistics)

From macroeconomic forces to custody architecture, each speaker offered a distinctive lens on gold’s enduring role in wealth management.

Matrixdock contributed insights from the frontier where precious metals meet tokenisation, presenting a vision for a modern “gold renaissance” through XAUm, our tokenised gold product. In this new model, gold’s centuries-old monetary foundation is elevated by blockchain-based transparency, settlement efficiency, and programmability.

XAUm is not a niche experiment; it represents a structural shift in wealth architecture, transforming gold from a static reserve asset into a programmable, mobile, and institution-grade component of next-generation finance.

Key Insights from Matrixdock’s Presentation

✅ Trust is shifting from institutions to verifiable data

Tokenisation enables investors to verify reserves on-chain, in real time, independently.

✅ Fully-backed, institution-grade gold

1:1 backed by 99.99% LBMA-accredited bullion

Custodied by Brinks & Malca-Amit

Physical redemption from 1kg

Independent semi-annual audits

✅ A new benchmark for transparency

XAUm’s reserve look-up tool lets users verify every bar — including serial number, vault location, fineness, and weight.

✅ Programmable, liquid, 24/7 gold

Fractional ownership, fast settlement, and global mobility unlock new wealth-management and treasury capabilities.

✅ Gold + Bitcoin: a unified programmable system

Through DeFi, XAUm can be swapped, collateralised, lent, or paired with Bitcoin for diversified strategies, combining two neutral assets within a single digital architecture.

Tokenisation Is Becoming a Fiduciary Responsibility

The real-world asset (RWA) tokenisation market is scaling rapidly, up 380% in three years to US$24B (mid-2025), according to RWA.xyz. This growth reflects accelerating real-world utility, not speculation.

Key drivers of institutional adoption include:

Regulatory guidance supporting institutional participation

Institutional capital flowing into tokenised assets

Ecosystem readiness, such as stablecoins, digital asset custody, and cross-chain settlement standards

Better market access, including previously gated assets like investment-grade physical gold, private credit, and trade finance

For wealth managers, the implications are clear:

Understanding tokenisation is becoming a fiduciary obligation. Especially, next-generation wealth holders are already allocating. Advisers equipped with RWA knowledge will be best placed to deliver sophisticated, compliant, and future-ready solutions.

You can read the full Hubbis interview here, where we explore why tokenised gold is gaining momentum across Asia and how it’s reshaping wealth strategies:

Hubbis Matrixdock Interview: Why Tokenised Gold is Reshaping Wealth Strategies in Asia

You can also access interviews with other speakers from various perspectives and solutions.

Hubbis WGC Interview: Marissa Salim on Gold’s Renaissance: Strategic Roles, HNW Demand, and Southeast Asia’s Enduring Faith in the Metal

Hubbis J.Rotbart Interview: Gold 360° – From Safe Haven to Strategic Asset: Joshua Rotbart on Physical Gold for HNW Clients

Hubbis Loomis Interview: Loomis International: Strategic Custody and Global Logistics for a Volatile World