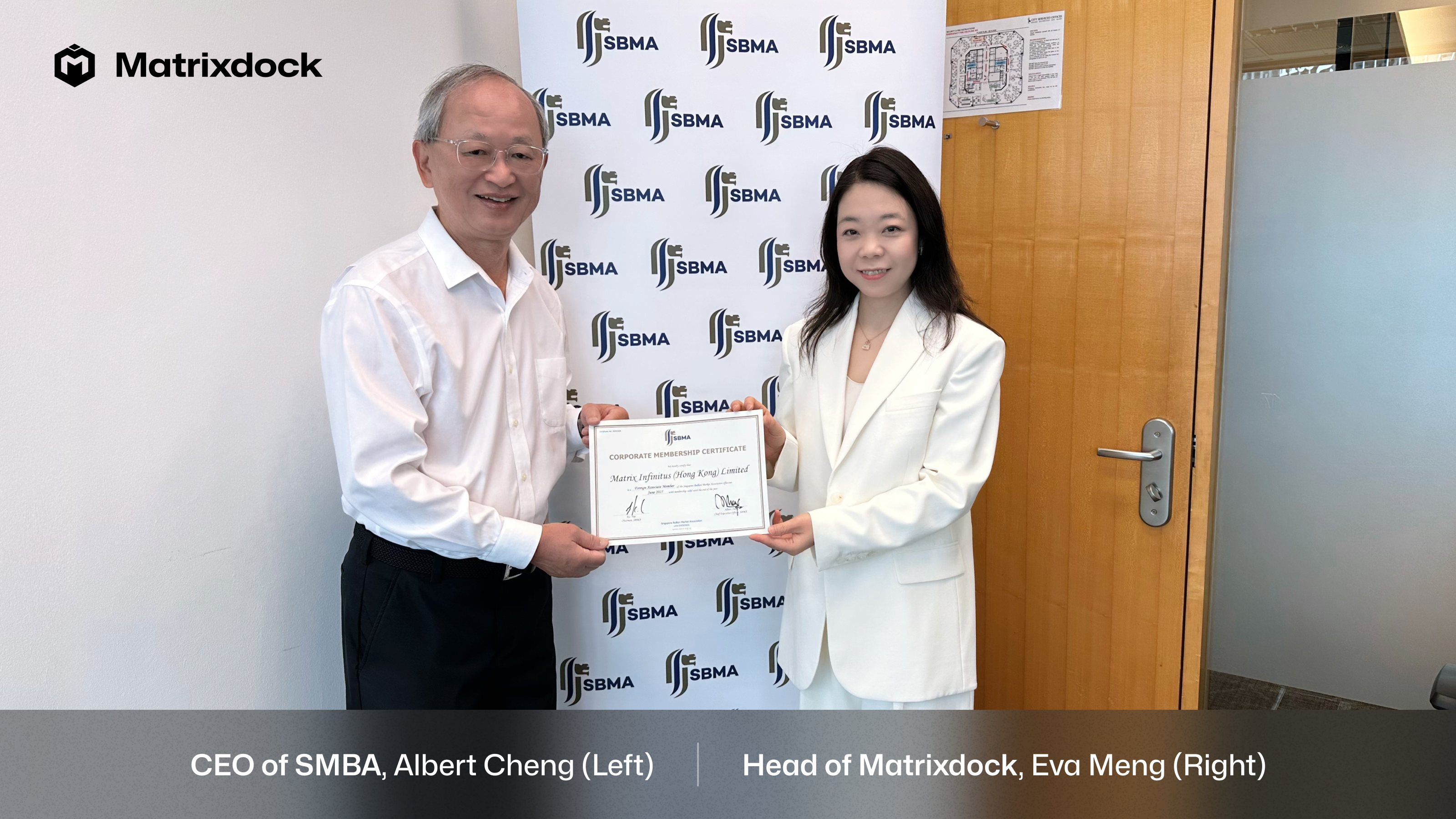

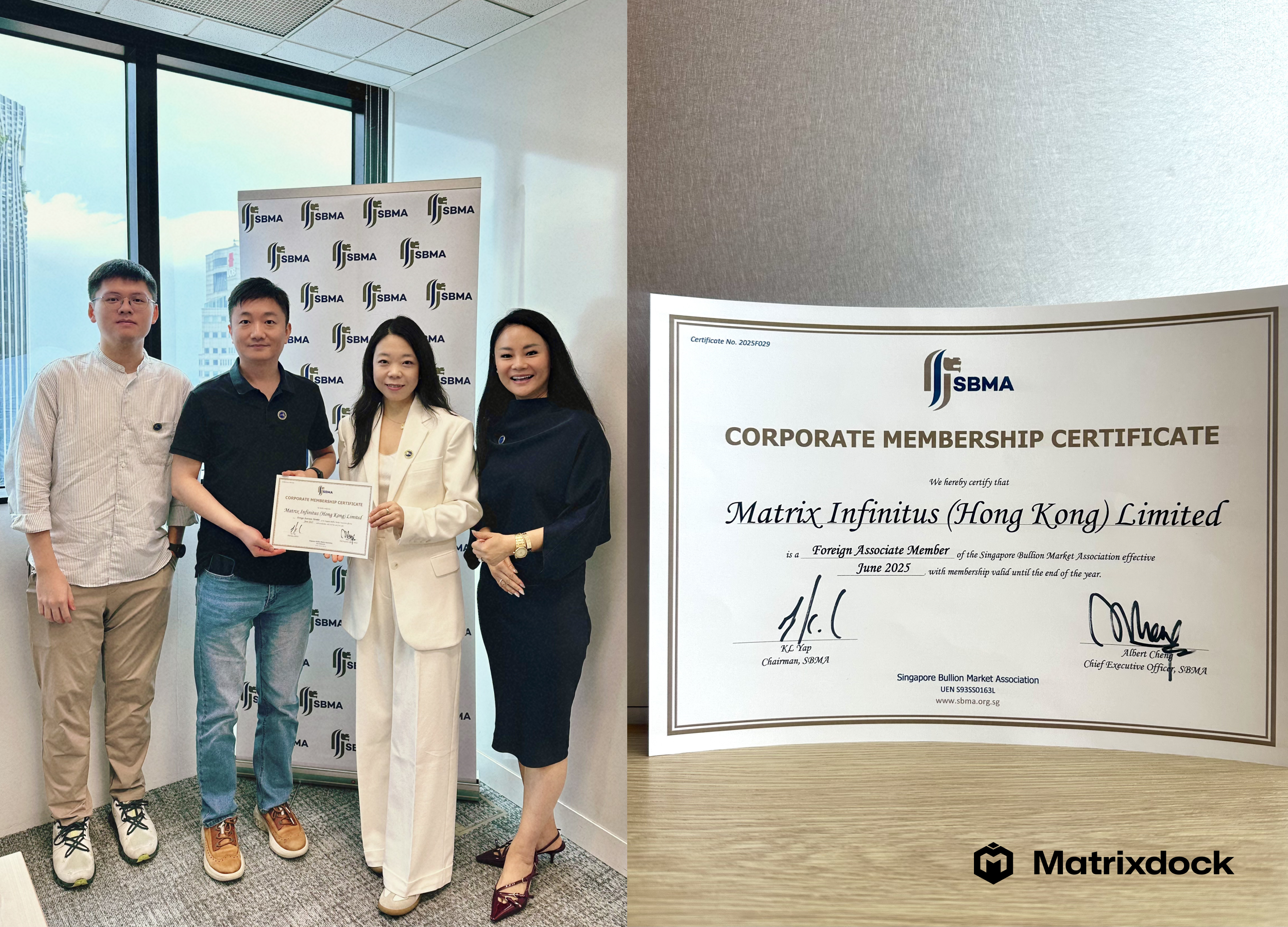

Matrixdock, the real-world asset (RWA) tokenization platform under the Matrixport Group, proudly announces its official membership in the Singapore Bullion Market Association (SBMA)—a pivotal step in reinforcing its commitment to transforming gold into a digitally native asset for enhanced accessibility.

As a member of SBMA, Matrixdock is honored to join a network of leading global bullion market participants and contribute actively to the evolution of gold investment channels. This membership reflects our dedication to shaping the future of how gold is owned, held, and traded by harnessing cutting-edge tokenization technology to bring unparalleled transparency, accessibility, and efficiency to the precious metals market.

Pioneering the Modern Gold Standard

Matrixdock’s flagship gold token, XAUm, is a first-class institutional-grade digital asset-backed 1:1 by fully allocated, 99.99% purity gold from LBMA-accredited refiners. XAUm represents auditable ownership of physical gold, verifiable on-chain and redeemable on demand. It is engineered for both institutional portfolios and digital-native investors seeking secure exposure to gold, with utility across decentralized finance (DeFi) and centralized platforms.

Matrixdock is setting the benchmark for tokenized gold in terms of reserve integrity, cross-chain interoperability, and institutional-grade infrastructure. Our participation in SBMA marks a new chapter of collaboration with market leaders to modernize gold’s role in the financial system.

Matrixdock is the brand name operated by Matrix Infinitus (Hong Kong) Limited, the legal entity recognized in official memberships and registrations with the Singapore Bullion Market Association.

Rising Global Demand and Singapore’s Strategic Role

With rising macroeconomic uncertainty, capital flows into gold are accelerating, particularly from Asia. Singapore sits at the epicenter of this shift. Often referred to as the “Geneva of the East,” Singapore offers unmatched advantages for the storage, trading, and allocation of gold.

It is home to Asia’s largest private banking asset base, making it a hub for affluent and institutional investors seeking physical gold allocations, especially for the new generation of wealth.

Singapore’s neutral geopolitical stance, robust legal framework, and world-class infrastructure make it a preferred destination for wealth preservation.

As a long-established gold distribution center since the 1960s, Singapore provides a strong foundation for the next evolution of gold markets where physical gold goes on-chain.

Looking Ahead

Matrixdock’s SBMA membership reflects its commitment to supporting Singapore’s ambition to be a global precious metals trading and wealth management hub. We look forward to working closely with fellow members to uphold best practices, foster innovation, and promote the tokenization of precious metals as a trusted and scalable solution for the next generation of investors.

Disclaimer: This content is for informational purposes only and does not constitute investment advice, an offer to sell, or a solicitation to buy any digital assets. Users are solely responsible for conducting their own due diligence and should consult with qualified financial, legal, and tax advisors before engaging in any decentralized finance activity. The availability, functionality, and redemption features of XAUm may vary by jurisdiction and remain subject to platform terms and applicable laws and regulations. Membership in the SBMA does not constitute or imply any form of regulatory approval or endorsement. Any references to gold market trends are provided solely for general informational purposes and do not represent the performance, risk profile, or suitability of any specific product or token.