We are entering a period of profound economic uncertainty as U.S. and Chinese markets decouple —with far-reaching consequences still unknown. In this environment, traditional “safe” assets like the U.S. Treasury no longer offer the same confidence. Investors increasingly seek refuge in hard assets that can preserve and grow value amid volatility.

Gold—politically neutral and time-tested— has always been the ultimate safe haven. And now, there’s a smarter, more capital-efficient way to own it.

Enter XAUm: Physical Gold with Programmable Power

XAUm is Matrixdock’s tokenized gold product, backed 1:1 by LBMA-accredited, 99.99% purity physical gold securely stored in fully insured vaults in Singapore and Hong Kong. Bureau Veritas independently audits these holdings, which are safeguarded by leading industry partners—including Le Freeport, Brink’s, and Malca-Amit—to ensure asset integrity and physical redemption.

What sets XAUm apart is that it’s more than just a passive store of value. It represents programmable, on-chain gold— built for use across both Centralized Finance (CeFi) and decentralized finance (DeFi) environments for a modern approach to gold ownership.

Why Use Leverage on Spot Gold?

In the current macro environment, gold continues to show strong upward momentum as global uncertainty drives demand for hard assets. The XAUm Leveraged Spot Gold Strategy is designed for investors with a higher risk appetite who want to amplify potential returns while holding investment-grade physical gold.

Unlike derivatives such as futures or perpetuals, XAUm enables you to increase your exposure without relying on synthetic instruments.

With this strategy, investors can potentially grow both their USD-denominated profits and their actual gold holdings over time—offering a practical, asset-backed alternative to traditional leveraged trading.

‼️ Note: Leveraged positions carry inherent market risks. Please review the full risk disclaimer at the end of this article.

How Does It Work: XAUm Leverage Mechanics

1. Leverage Boosts Exposure:

You start with $3,000 → buy 1 XAUm (1 troy ounce of gold at $3,000).

With 2x leverage, your total exposure becomes 2 XAUm ($6,000).

To achieve this, you borrow an additional $3,000.

Your net value (your equity after subtracting the loan) starts at $3,000.

Net value = Total asset value – borrowed amount. This reflects your true ownership position.

2. Gold Price Appreciation Multiplies Gains:

If gold rises to $3,500, your 2 XAUm exposure becomes $7,000.

Subtract the $3,000 loan + interest repayment → Net value now is close to $4,000.

☝🏼 Your XAUm position increases from 1.00 XAUm (1 troy ounce of gold) to approximately 1.14 XAUm (1.14 troy ounces of gold).

(Calculation: 4,000/ 3,500 = 1.14 )

🟠 USD-denominated profit: 33% return vs. 16.6% in the unleveraged case

🟠 Gold ownership: 14% increase vs 0% in the unleveraged case

As illustrated above - when you close the position either by settling the loan via selling XAUm exposure or through repaying stablecoins, the result of a profitable trade could be an increase in actual gold holdings in the form of XAUm quantity. Unlike derivatives, where PnL is realized purely in USD, the XAUm Leveraged Spot Gold Strategy gives you the ability to grow your actual, physical gold ownership over time—depending on how you manage repayments or reinvest your gains.

Accessing the Strategy

1. CeFi Access: Matrixport App

Leverage up to 5x

Use XAUm or USDT as collateral

Real-time position management and adjustment

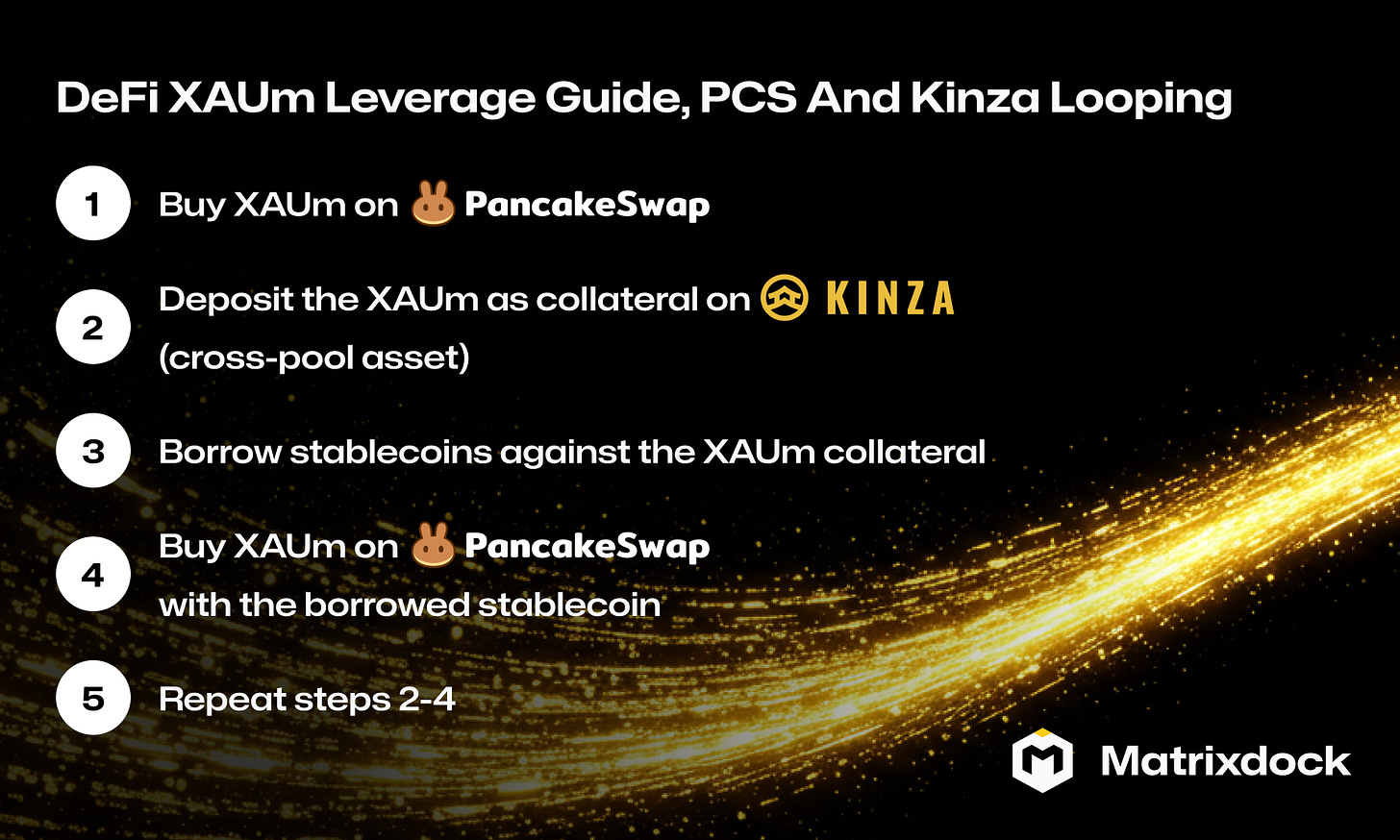

2. DeFi Access: PancakeSwap + Kinza Finance on BNB Chain

Buy XAUm on PancakeSwap

Deposit XAUm on Kinza as collateral

Borrow stablecoins to purchase more XAUm

A decentralized, looping strategy to compound gold exposure

Why This Matters Now

Gold isn’t just a trading instrument—it’s insurance. In today’s market, owning gold directly, transparently, and in a more capital-efficient way is essential.

With XAUm:

You hold real gold, not structured derivatives

You can leverage more safely without the trapdoors of derivatives

You gain yield opportunities via CeFi and DeFi

You’re in control—your gold, your collateral, your strategy

Final Thoughts

In times of uncertainty, hard assets shine. With the Leveraged Spot Gold Strategy powered by XAUm, you get the best of both worlds: the security of physical gold and the performance of a digital asset investment tool.

Whether you’re hedging against inflation, reallocating from USD assets, or simply seeking a more dynamic exposure to gold—XAUm has you covered.

Risk Disclaimer

Leveraged spot gold strategies involve a higher level of risk and are not suitable for all investors. Market volatility, price fluctuations, and liquidation risks should be carefully considered. All investment decisions, including the use of leverage, are made at the sole discretion of the user. Matrixdock, Matrixport and associated platforms do not provide financial advice and shall not be held responsible for any outcomes resulting from individual investment strategies. Please assess your risk tolerance and consult with a licensed financial advisor if needed. Figures provided are for illustration purposes only and do not constitute a guarantee or warranty in any kind.